What is VITA?

VITA stands for Volunteer Income Tax Assistance and is a nationwide IRS program that offers FREE tax preparation assistance to people who generally make $64,000 or less, including persons with disabilities, the elderly, and English/Spanish speaking taxpayers who need assistance in preparing their tax returns. United Way of Stanislaus County partners with the Internal Revenue Service (IRS) to provide this free service to residents of Stanislaus County. Tax preparation services are provided by trained, IRS-certified volunteers. All locations are IRS-authorized e-file providers.

Who qualifies for VITA free tax preparation?

Eligibility for free tax filing

Income $64,000 or less

No rental income (from a property you own)

Did not file for bankruptcy last year

Had no cancellation of debt outside of non-business credit cards

No clergy income

If married, are filing jointly

If self-employed, no business-related expenses over $35,000 or businesses with employees, inventory, business property, net loss, or depreciating assets.

No sales of cryptocurrency

How can I find a VITA site?

United Way of Stanislaus County’s VITA program is located in Modesto at 422 McHenry Avenue. Appointments are recommended and can be scheduled at myfreetaxes.org For other locations, call 211 or 1-877-211-7826 or text your zip code to 898211 to speak to a specialist who can direct you to a site nearest you.

Items to bring to your appointment:

Proof of identification (photo ID)

Social Security cards for you, your spouse and dependents

An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

Proof of foreign status, if applying for an ITIN

Birth dates for you, your spouse and dependents on the tax return

Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers

Interest and dividend statements from banks (Forms 1099)

All Forms 1095, Health Insurance Statements

Health Insurance Exemption Certificate, if received

A copy of last year’s federal and state returns, if available

Proof of bank account routing and account numbers for direct deposit such as a blank check

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number

Copies of income transcripts from IRS and state, if applicable

Self Preparation

Free self-preparation is available at myfreetaxes.org if your annual income is $64,000 or less.

To stay up-to-date on information and resources, text “taxes” to 211-211

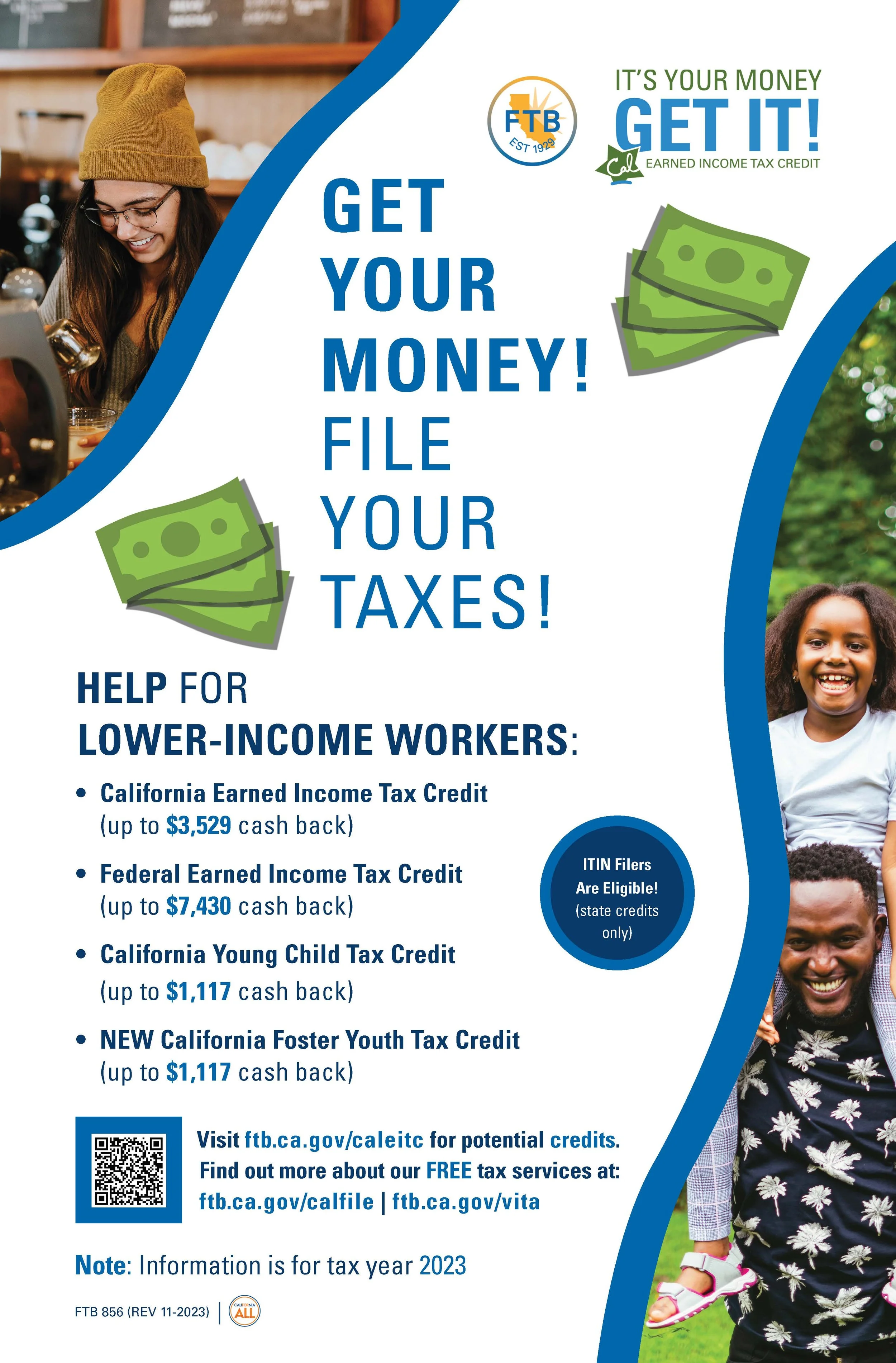

Cal EITC